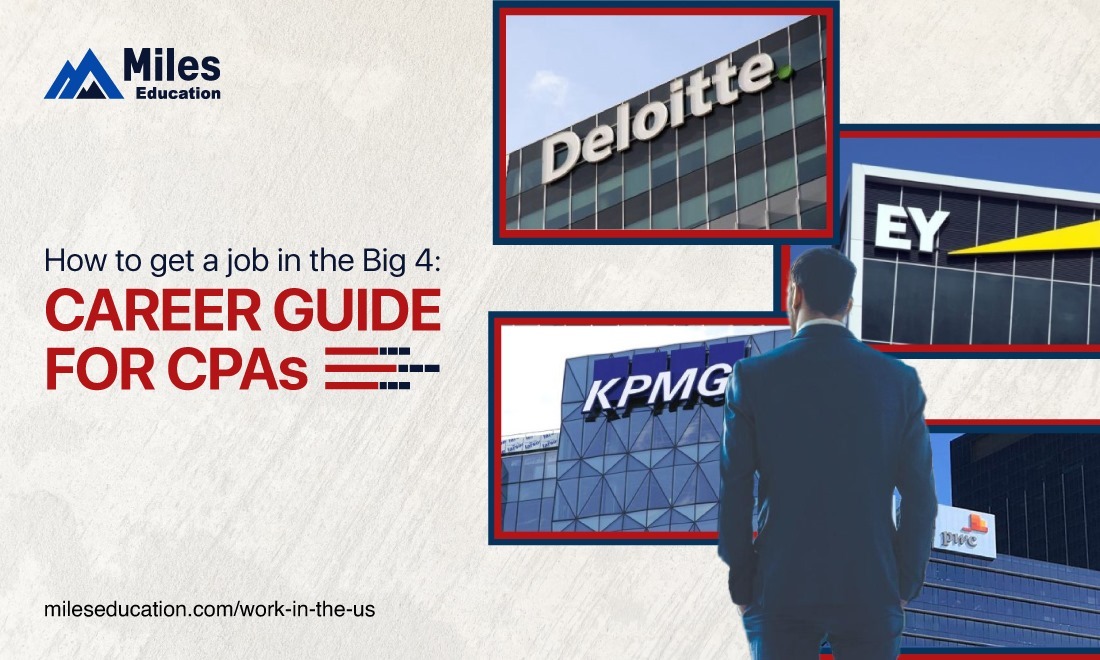

If you’re a Certified Public Accountant (CPA) and looking to work for one of the Big 4 accounting firms, which include Deloitte, PricewaterhouseCoopers (PwC), Ernst & Young (EY), and KPMG, you’re in for a challenging but rewarding career.

These firms are known for their global presence, prestigious client base, and diverse range of services. Landing a job at one of the Big 4 can open up doors to exciting opportunities and career growth. Here’s a comprehensive career guide for CPAs on how to get a job in the Big 4.

CPA Career Guide: Steps to Secure a Big 4 Job

- Obtain the CPA certification: To work in the Big 4, having a CPA certification is highly recommended.It’s considered a valuable credential and demonstrates your expertise in the field of accounting.

You’ll need to meet the requirements set by your state or country, which typically include completing a certain number of credit hours and

passing the CPA exam. The CPA certification can give you a competitive edge and increase your chances of being considered for a job at the Big 4. - Build a strong educational foundation: In addition to obtaining the CPA certification, having a strong educational background is crucial. Most Big 4 firms require a minimum of a bachelor’s degree in accounting or a related field, while some may prefer a masters degree or higher.

Ensure that your educational qualifications align with the requirements of the Big 4 firms you’re interested in, and consider pursuing additional certifications or specializations to further enhance your skills and knowledge.

- Gain relevant work experience: While some Big 4 firms may hire fresh graduates, having relevant work experience can greatly increase your chances of getting a job in the Big 4. Start by gaining practical experience through internships, co-op programs, or entry-level positions at accounting firms. This will help you develop relevant skills, such as auditing, financial reporting, tax planning, and consulting, which are highly valued by the Big 4 firms.

Look for opportunities to work with clients in different industries to diversify your experience and demonstrate your adaptability.

- Network extensively: Networking is crucial in the accounting industry, and it’s especially important when it comes to landing a job in the Big 4. Attend career fairs, industry events, and professional networking events to meet professionals from the Big 4 firms and other accounting firms. Join accounting associations and participate in their activities to expand your network.

Utilize social media platforms like LinkedIn to connect with professionals in the field and learn about job opportunities. Building a strong professional network can help you access hidden job markets, gain insights about the hiring process, and receive referrals.

- Research and target the right firm: Each of the Big 4 firms has its unique culture, values, and areas of expertise. Do your research and understand the differences between the firms to identify the one that aligns with your career goals and interests. Consider factors such as the firm’s size, clients, service lines, industry focus, and global presence.

Tailor your application and interview preparation based on the firm you’re targeting to demonstrate your genuine interest in their organization.

- Prepare a compelling application: Your application, including your resume, cover letter, and any other required documents, should be well-crafted and tailored to the Big 4 firm you’re applying to. Highlight your relevant skills, qualifications, and work experience that align with the firm’s requirements.

Provide examples of your achievements and how you’ve added value to your previous employers. Proofread your application thoroughly to ensure it’s error-free and professional.

- Ace the interviews: If your application is shortlisted, you may be invited for an interview. The interview process at the Big 4 can be rigorous and may include multiple rounds of interviews, including phone interviews, video interviews, and in-person interviews. Be prepared to showcase your technical knowledge, problem-solving skills, and ability to work in a team.

Research common interview questions asked in the accounting industry and practice your responses. Be ready to discuss your relevant work experience, accomplishments, and how you can contribute to the firm’s goals. Also, be prepared to ask thoughtful questions about the firm and its services during the interview to demonstrate your genuine interest and engagement.

- Demonstrate soft skills: In addition to technical skills, Big 4 firms also value soft skills, such as communication, leadership, teamwork, adaptability, and problem-solving. These skills are essential for working in a fast-paced, client-centric environment. Highlight your soft skills in your application and interviews by providing examples of how you’ve demonstrated these skills in your previous work experiences.

Showcase your ability to work well with others, adapt to changing situations, and handle challenges professionally.

- Be persistent and patient: Landing a job in the Big 4 can be highly competitive, and the hiring process may take time. Be prepared to face rejections or delays and do not get discouraged.

Be persistent in your job search efforts, continue to build your skills and network, and keep improving your application and interview skills. It’s important to stay patient and maintain a positive attitude throughout the process.

- Consider other entry points: While getting a job directly with the Big 4 firms may be challenging, other entry points can eventually lead to a career in the Big 4. You can start your career in a smaller accounting firm or in the accounting department of a large corporation to gain relevant experience and develop your skills.

You can also consider working for a Big 4 firm in a different country or region where the

demand for CPAs may be higher. Once you have gained relevant experience, you can reapply to the Big 4 firms with an enhanced resume and skill set.

Unlock Opportunities Beyond the Big 4: Accounting Careers in Top US Firms

While the Big 4 remains the ultimate dream for accountants, Miles has expanded the horizons for Indian professionals. Now, secure on-site positions in top US accounting firms through Miles’ innovative approach. Leveraging a tech playbook, we’ve partnered with leading US universities, transforming accounting programs into STEM with integrated Business Analytics. This allows Indian accountants to enjoy 3 years of US work on their student F1 visa, extendable up to 6 years with an H1B visa.

In conclusion, a successful career in the Big 4 requires technical expertise, work experience, networking, and persistence. Supplementing with specialized education from Miles Education can provide an added advantage for aspiring accountants and finance professionals to excel in the competitive field of accounting and finance.

Given that 80%+ CPAs in India are Miles alumni, all of the Big 4 recruitment teams work closely with Miles, the best CPA course providers in India, for their CPA talent requirements. Consider leveraging Miles Education’s comprehensive programs, including their CPA exam preparation, to enhance your career prospects in the Big 4.

2 thoughts on “How to get a job in the Big 4: Career Guide for CPAs”

As i am a fresher what are some of the technical skills that I can upskill in along with my US CPA so that I can enhance my resume and better my chances of acquiring a job with one of the big 4s in India?

Along with your US CPA, some technical skills you could upskill in to enhance your resume and improve your chances of getting a job with one of the big 4 in India include data analytics, accounting software proficiency (such as QuickBooks or Xero), and knowledge of international tax laws. These skills will demonstrate your ability to handle complex tasks and stay up-to-date with industry trends.