Introduction:

The Certified Public Accountant (CPA) qualification is highly esteemed in the field of accounting and finance. Individuals who aspire to pursue a career in this domain often consider obtaining the CPA credential.

If you are in India and interested in becoming a CPA, it is essential to understand the CPA eligibility requirements, exam details, syllabus, and other relevant information.

This comprehensive blog aims to provide you with all the necessary details regarding CPA eligibility in India, along with insights into Miles Education, a trusted CPA exam preparation provider.

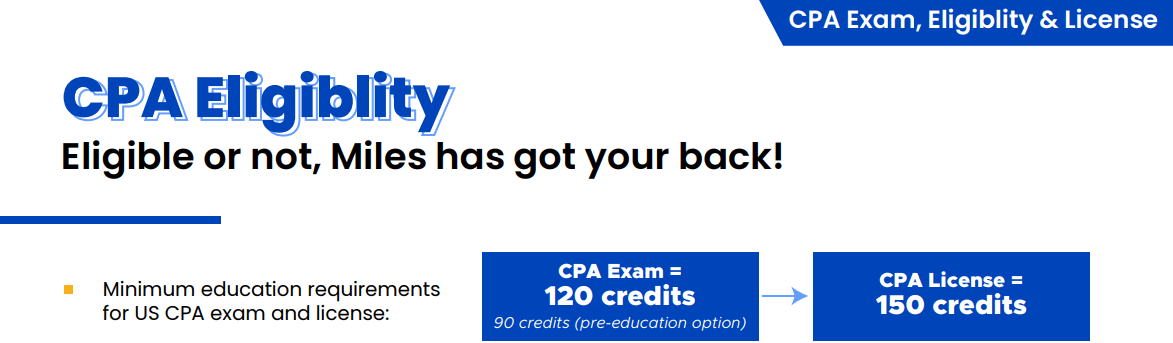

CPA Eligibility

To be eligible for the CPA exam in India, candidates must meet specific educational qualifications and comply with the criteria set by the respective authorities. The following are the key eligibility requirements:

Educational Qualifications:

- Bachelor’s Degree: Candidates must possess a bachelor’s degree from a recognized university or educational institution.

- Accounting and Finance Courses: It is advisable to have completed specific accounting and finance courses, such as auditing, taxation, financial accounting, cost accounting, and management accounting.

Work Experience:

- Practical Experience: Candidates must have acquired relevant work experience in the accounting field, typically ranging from 1 to 3 years.

CPA Exam Details:

The CPA exam consists of four sections, namely Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG). Each section assesses different aspects of accounting and requires in-depth knowledge. Here are the essential details regarding the CPA exam in India:

CPA Exam Pattern:

- Multiple-Choice Questions (MCQs): The exam includes multiple-choice questions to evaluate candidates’ understanding and application of accounting concepts.

- Task-Based Simulations (TBS): TBS are practical scenarios that assess candidates’ skills in real-world accounting tasks.

- Written Communication Tasks: This section tests candidates’ ability to communicate effectively in writing.

Exam Duration and Schedule:

- Exam Duration: Each section of the CPA exam is four hours long.

- Exam Dates: The CPA exam is typically conducted in designated testing windows throughout the year. Candidates can choose their preferred exam dates based on availability.

CPA Exam Module and their Weightage

Topic | Weightage |

Auditing and Attestation (AUD) | MCQs = 50% TBSs = 50% |

| Financial Accounting and Reporting (FAR) | MCQs = 50% TBSs = 50% Written Communication 15% |

| Regulation (REG) | MCQs = 50% TBSs = 50% |

| Business Environment and Concepts (BEC) | MCQs = 50% TBSs = 50% |

| Information Systems and Controls (ISC) | MCQs = 60% TBSs = 40% |

| Tax Compliance and Planning (TCP) | MCQs = 50% TBSs = 50% |

Miles Education is the trusted CPA Exam Preparation Provider, When it comes to preparing for the CPA exam, choosing the right study materials and guidance is crucial. Miles Education is a renowned institute that offers comprehensive CPA exam preparation courses in India.

With its expert faculty and well-structured study programs, Miles Education has helped numerous aspiring CPAs achieve success hence we proudly say that 82% of CPAs in India are Miles Alumni They provide comprehensive study materials, online lectures, practice questions, and mock exams to ensure candidates are well-prepared for the CPA exam. Additionally, their personalized guidance and support help candidates navigate the exam preparation process smoothly.

CPA Eligibility FAQs

Q1: What is the full form of CPA?

A1: CPA stands for Certified Public Accountant.

Q2: What qualification is required for CPA?

A2: Minimum CPA Eligibility is a bachelor’s degree in accounting, where you need 120 credits for becoming eligible for the CPA exam and 150 credits (Bachelor’s + Master’s) to gain a CPA license.

If you don’t belong to an accounting background you can opt for a bridge course in accounting to become eligible for CPA certification

Q3: What is the syllabus for the CPA exam?

A3: The CPA exam syllabus covers four sections: Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG).

Note* However, the CPA exam syllabus will change in 2024 where BEC will get divided into three parts and the candidates will have to choose any one out of 3

Q4: Which part of the CPA exam is easiest?

A4: BEC is considered the easiest part of the CPA exam because it has the highest pass rate

Q5: How difficult is CPA? What is the pass rate for the CPA exam?

A5: The Certified Public Accountant (CPA) exam is a challenging and rigorous test that requires a strong foundation in accounting and finance. The difficulty of the CPA exam may vary depending on an individual’s background and strengths. Some candidates may find the exam more challenging than others, depending on their education and experience.

The global pass rate for the CPA exam is around 50%. However, it is important to note that the pass rate can vary from year to year and from jurisdiction to jurisdiction. Some jurisdictions may have a higher or lower pass rate depending on various factors, such as the difficulty of the exam and the number of candidates who sit for it.

Conclusion:

Becoming a Certified Public Accountant is a significant milestone for individuals aspiring to excel in the accounting and finance field. By meeting the educational qualifications, understanding the exam details, and diligently preparing with the help of reputable institutions like Miles Education, candidates can increase their chances of success.

It is crucial to stay updated with the CPA exam requirements, syllabus, exam pattern, and important dates to plan your preparation effectively. Start your journey towards becoming a CPA today and unlock exciting career opportunities in the accounting profession.